Digital signature is a groundbreaking technology which can benefit many businesses, including the banking industry.

Due to the nature of their services, banks typically requires somebody to register a significant portion of their personal data before they can access their services. This process and many more that follow could be both time and cost consuming for both parties.

Moreover, banks are also heavily regulated by the government to protect their customers’ data. It comes without a surprise that these days more banks are using digital signature services not just to expedite their services, but also to give better protection for their customers.

But how exactly do digital signatures help advance banking services?

Digital Signatures Are More Cost-Effective

Today, businesses are increasingly going paperless. This system is viewed to be more cost effective compared to the one which still depends on paper documents. Using paper documents not only cause companies to incur more costs for the papers.

Furthermore, digital signatures eliminate any maintenance costs that are incurred when using printing machines, renting a space, and delivering via courier services.

Digital Signatures Help Banks Build Clients’ Trust

Digital signatures have been proven to help banking services gain clients’ trust. The encryption method contained in a digital signature makes them impossible to be forged.

In addition, digital signatures enable us to detect even the smallest modification in an electronic document after it has been signed. To ensure the utmost security, digital signatures can only be processed after going through multi-factor authentication.

In a nutshell, digital signatures play a huge factor in securing all online transactions. And when security is guaranteed, clients are more likely to trust your banking services.

Digital Signatures Significantly Reduce Transaction Time

When you rely on a manual signing process, a transaction becomes slower without you even noticing. Clients also need to spend some time for a customer diligence process known as KYC (Know Your Customer) session with the bank.

You might not realise this time-consuming process as you are used to the conventional system already. But if you convert to digital signatures, the process can be considerably streamlined.

With digital signatures, you no longer need to wait for a document to be signed by your client as in the conventional process. Clients can conveniently use the provided application, and follow the next steps without the need to visit banks anymore.

All of this process could be finished within a few minutes, as opposed to hours or even days required by the manual signing process.

Also read: Digital Signatures Support Indonesian Financial Inclusion

Digital Signatures Are More practical

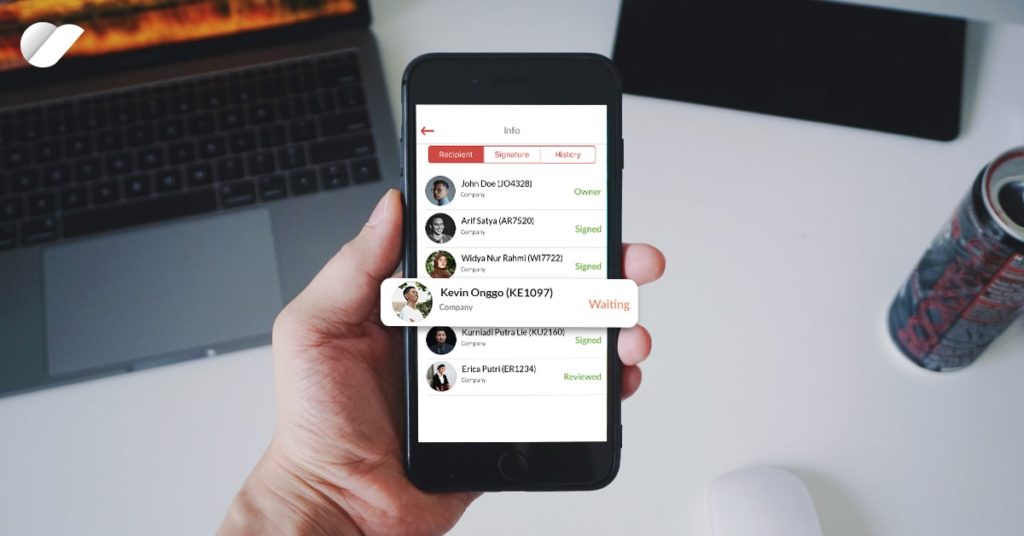

Do you frequently find yourself complaining about not knowing the status of a document that must be signed? This situation can be prevented if you are using a digital signature.

Digital signature services are usually complemented with an online platform interface that enables you to track a document easily. Documents are also stored in Cloud computing, thus making it accessible anywhere from whatever gadgets you are using.

Keeping in mind the vast advantage that digital signatures offer, it isn’t surprising to see many reputable banks in Indonesia has already started to collaborate with digital signature services.

For example, two of Indonesia’s largest banks CIMB Bank and Mandiri Bank have collaborated with PrivyID to simplify the bookkeeping processes of their clients’ accounts. Now, both banks do not need to spend much time and money to bring in new clients. Clients also experience the benefits of a digital signature platform accessible from their own smartphones.